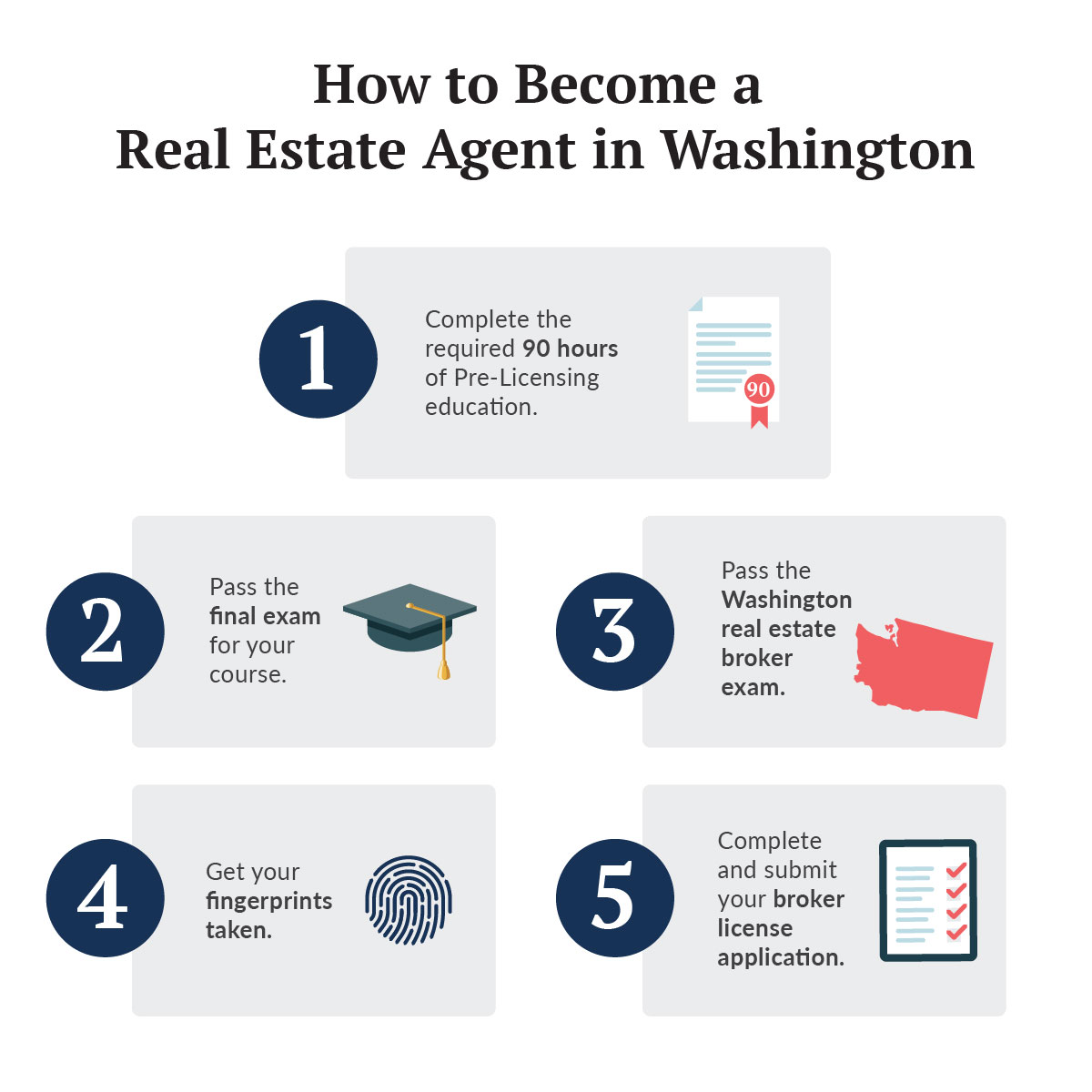

The process of obtaining a Massachusetts real-estate license is relatively straightforward. The state has many requirements that applicants must comply with. It is also easy and there are many prelicensing courses. These classes are available online and can be done at your own pace with many options. Whether you are a new grad looking for a career in real estate or a seasoned pro, you can find a class to suit your needs.

In order to become a professional real estate agent you need to have completed the necessary pre-licensing requirements. This includes 40-hours of approved classes. Also, you will need to pass a background screening, get a surety bonds, and apply for a licence. The cost of a Massachusetts realty license is about $600. Depending on the course you choose, you may be able to enroll in a course at night, online, or even livestream. If you don't have the time to take a full-time course, you can attend classes at an approved school.

To be licensed in Massachusetts, you must also complete the Massachusetts pre-licensing requirements. PSI administers this test, which is split into two sections. The first section covers the general overview of national regulations. The second covers the comprehensive examination of Massachusetts laws and regulations. Each section of the exam will end with a diagnostic report. This report is helpful because it can help you prepare the exam and be used as a reference during a retake.

To obtain a real estate license, you will need to pass a criminal background screening. If you have any criminal convictions, a background search will only be required. It will not be required for cases involving disciplinary action against your license. A background check will be required if you have been convicted of driving under the influence.

You will also need to pay an exam fee. This fee can be paid using a credit card or a debit card. A form for admittance to the exam is also required. The application fees are $31 and exam fees are $54. You can pay the application fee using a debit or credit or by check payable to PSI. The fee must be paid at least 30 working days prior to the exam. Centers will charge a different fee, but they could range from $103 to $150.

Once you've completed the pre-licensing requirements, it's time to study for the real estate exam. You can take the exam at an authorized testing center in person or you can do it online at your own pace. To pass, you must answer at least 70% of the questions. You can also take a practice exam if you're concerned about passing the actual exam.

FAQ

Is it possible to quickly sell a house?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. You should be aware of some things before you make this move. First, you need to find a buyer and negotiate a contract. Second, prepare the house for sale. Third, your property must be advertised. Finally, you need to accept offers made to you.

Is it better to buy or rent?

Renting is generally cheaper than buying a home. But, it's important to understand that you'll have to pay for additional expenses like utilities, repairs, and maintenance. A home purchase has many advantages. You will be able to have greater control over your life.

Can I afford a downpayment to buy a house?

Yes! Yes. These programs include FHA, VA loans or USDA loans as well conventional mortgages. Check out our website for additional information.

Should I use a mortgage broker?

A mortgage broker can help you find a rate that is competitive if it is important to you. Brokers are able to work with multiple lenders and help you negotiate the best rate. Some brokers receive a commission from lenders. Before signing up, you should verify all fees associated with the broker.

Do I need flood insurance?

Flood Insurance covers flood damage. Flood insurance protects your possessions and your mortgage payments. Learn more about flood insurance here.

How many times may I refinance my home mortgage?

This depends on whether you are refinancing with another lender or using a mortgage broker. In either case, you can usually refinance once every five years.

What are the downsides to a fixed-rate loan?

Fixed-rate loans have higher initial fees than adjustable-rate ones. If you decide to sell your house before the term ends, the difference between the sale price of your home and the outstanding balance could result in a significant loss.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

How to purchase a mobile home

Mobile homes are houses that are built on wheels and tow behind one or more vehicles. Mobile homes were popularized by soldiers who had lost the home they loved during World War II. People today also choose to live outside the city with mobile homes. These houses are available in many sizes. Some houses can be small and others large enough for multiple families. There are even some tiny ones designed just for pets!

There are two main types mobile homes. The first type is manufactured at factories where workers assemble them piece by piece. This is done before the product is delivered to the customer. A second option is to build your own mobile house. It is up to you to decide the size and whether or not it will have electricity, plumbing, or a stove. Next, ensure you have all necessary materials to build the house. Finally, you'll need to get permits to build your new home.

Three things are important to remember when purchasing a mobile house. First, you may want to choose a model that has a higher floor space because you won't always have access to a garage. You might also consider a larger living space if your intention is to move right away. The trailer's condition is another important consideration. Damaged frames can cause problems in the future.

It is important to know your budget before buying a mobile house. It is important that you compare the prices between different manufacturers and models. Also, take a look at the condition and age of the trailers. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

A mobile home can be rented instead of purchased. Renting allows the freedom to test drive one model before you commit. However, renting isn't cheap. Renters typically pay $300 per month.