Here are some tips to maximize your real estate investment returns. Read on to learn more about the types of properties you can invest in. You will also learn about the importance location and asset protection. These tips can help you to maximize your investment success. This article will help you if your first investment or if multiple properties are in your future.

Investment properties

What makes investment properties for real-estate investors attractive? It all depends on your goals, your market, and your preferred investment strategy. These questions are not easy to answer. It is important to weigh the pros and cons for each investment option. It is also important to consider where you are located. Investors in "up and coming" markets might be more inclined to invest in vacant land while investors in mature markets might be more interested residential properties.

Asset protection

You have a number of options to protect your assets when you are serious about investing in real property. The majority of real estate investors have landlord insurance. If you don't have a lot of debt, you can use an LLC to secure your assets. It is important to consider how much equity your properties have. The best strategy depends on your goals, investment preferences, and risk tolerance.

Localization

Location is everything in real estate investing, and the location you buy your property in will greatly impact your return on investment. Even though cheaper properties might not be as profitable as those with higher prices, it is worth considering the area surrounding your property. Some neighborhoods are booming, and others may not be the best investments. It is important to consider the area’s affordability and the job market before you decide whether this property is the right one for you. Final, ensure that you have thoroughly checked the property before making your final decision.

Refinance existing homes

Refinancing existing properties for real-estate investors allows you to take advantage of lower interest rates and lowered monthly payments to maximize your investment. You can refinance existing properties to make improvements or finance other investments. A refinance may also offer tax deductions, so it's a great option for investors. However, it involves several steps. Here are the steps to get you started.

Managing your own portfolio

When it comes to starting your own real estate portfolio, you have many decisions to make. The appropriate asset allocation depends on your goals and risk tolerance. You will need to take greater risks if you want higher returns. However, investors who are looking to earn a steady and predictable income will choose to invest in safer assets. Generally, a higher risk tolerance leads to a more aggressive real estate portfolio. But how do you know which investments are best?

FAQ

How do I calculate my rate of interest?

Market conditions can affect how interest rates change each day. The average interest rate for the past week was 4.39%. The interest rate is calculated by multiplying the amount of time you are financing with the interest rate. If you finance $200,000 for 20 years at 5% annually, your interest rate would be 0.05 x 20 1.1%. This equals ten basis point.

What are the chances of me getting a second mortgage.

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage is used to consolidate or fund home improvements.

Is it possible fast to sell your house?

You may be able to sell your house quickly if you intend to move out of the current residence in the next few weeks. But there are some important things you need to know before selling your house. First, find a buyer for your house and then negotiate a contract. Second, prepare the house for sale. Third, your property must be advertised. You must also accept any offers that are made to you.

What is a "reverse mortgage"?

Reverse mortgages are a way to borrow funds from your home, without having any equity. You can draw money from your home equity, while you live in the property. There are two types available: FHA (government-insured) and conventional. Conventional reverse mortgages require you to repay the loan amount plus an origination charge. FHA insurance will cover the repayment.

What is the maximum number of times I can refinance my mortgage?

It depends on whether you're refinancing with another lender, or using a broker to help you find a mortgage. You can refinance in either of these cases once every five-year.

What should I do before I purchase a house in my area?

It depends on how much time you intend to stay there. If you want to stay for at least five years, you must start saving now. But if you are planning to move after just two years, then you don't have to worry too much about it.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

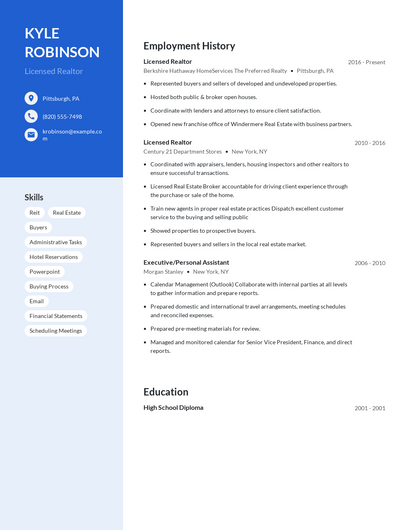

How to Find Real Estate Agents

The real estate market is dominated by agents. They offer advice and help with legal matters, as well selling and managing properties. A good real estate agent should have extensive knowledge in their field and excellent communication skills. Online reviews are a great way to find qualified professionals. You can also ask family and friends for recommendations. A local realtor may be able to help you with your needs.

Realtors work with buyers and sellers of residential properties. A realtor helps clients to buy or sell their homes. Realtors assist clients in finding the perfect house. Most realtors charge a commission fee based on the sale price of the property. Unless the transaction closes however, there are some realtors who don't charge a commission fee.

There are many types of realtors offered by the National Association of REALTORS (r) (NAR). NAR requires licensed realtors to pass a test. A course must be completed and a test taken to become certified realtors. NAR has set standards for professionals who are accredited as realtors.