Sellers looking to sell their house quickly without the help of a traditional agent can turn to companies that buy houses for money. These companies can quickly provide a cash quote for your home and close on the deal in a matter days, or even weeks.

The selling process to a company which buys houses in cash is straightforward. In some cases, you might even have a personal representative that helps guide the way. The initial contact or online form is where you can share information about the house.

After receiving the information, the representative will evaluate your property and make you a non-negotiable cash offer on your home. This offer is based upon the condition of your property and is usually a better deal than what you would get from other buyers.

Next comes a home inspection if you accept the cash deal. An inspector from a third party will inspect the property and make note of any repairs or maintenance that are needed. The home-buying company then modifies its offer, adjusting the price proportionally if any repairs are needed.

Another benefit of selling your home to a company that buys homes for cash is that you can avoid the hassle of dealing with a real estate agent, open houses, and other showings. A quick closing can save you significant time and stress.

If you are in an emergency financial situation or have been expelled, you may be able to use a company that purchases houses for cash to avoid foreclosure. So that you do not have to pay any fees or penalties for the foreclosure process, the company may be able help with all your moving costs.

There are some downsides to buying houses for cash. Some companies will offer you a lower price than the market. Companies trying to appeal to distressed home sellers are often attracted by this.

You can compare offers from top home buyers and get an opinion of a local realtor on the value of your home to determine which company is best for you. Clever Offers allows you to create a free account.

There are many types of companies that purchase houses for cash. Some include house flippers or real estate investors. Others are brokers and lenders who offer money to facilitate purchases. These traditional home-buying firms are not the only ones available. There are also iBuyers, homeowners and others who are interested in buying homes for cash.

Some are legitimate while others may be fraudulent. To make sure you don't end up getting ripped off, you should do your research and ask questions before you decide to work with any company.

FAQ

How do I know if my house is worth selling?

If you have an asking price that's too low, it could be because your home isn't priced correctly. A home that is priced well below its market value may not attract enough buyers. You can use our free Home Value Report to learn more about the current market conditions.

How long does it take to sell my home?

It depends on many factors including the condition and number of homes similar to yours that are currently for sale, the overall demand in your local area for homes, the housing market conditions, the local housing market, and others. It takes anywhere from 7 days to 90 days or longer, depending on these factors.

What should I look for when choosing a mortgage broker

A mortgage broker is someone who helps people who are not eligible for traditional loans. They work with a variety of lenders to find the best deal. Some brokers charge a fee for this service. Other brokers offer no-cost services.

How do I fix my roof

Roofs may leak from improper maintenance, age, and weather. Minor repairs and replacements can be done by roofing contractors. For more information, please contact us.

What is the maximum number of times I can refinance my mortgage?

This is dependent on whether the mortgage broker or another lender you use to refinance. In both cases, you can usually refinance every five years.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

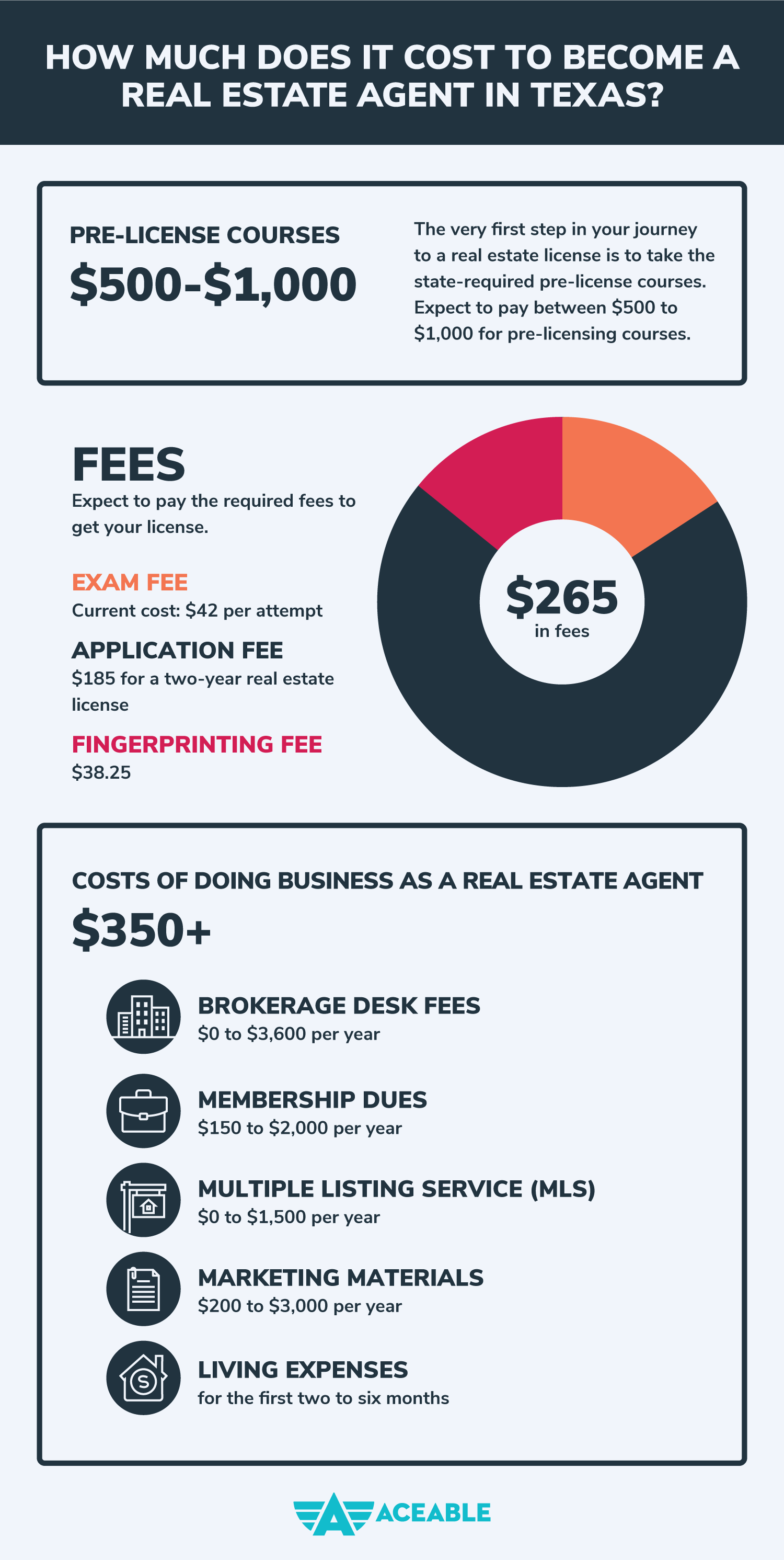

How to be a real-estate broker

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

Next, pass a qualifying test that will assess your knowledge of the subject. This means that you will need to study at least 2 hours per week for 3 months.

You are now ready to take your final exam. To become a realty agent, you must score at minimum 80%.

These exams are passed and you can now work as an agent in real estate.