The right agent can make a big difference in how you feel about buying a house. You need to make sure you're working with the right agent, not only to find the perfect house but also to ensure that your home is in the best possible condition. Here are some tips for choosing the right agent.

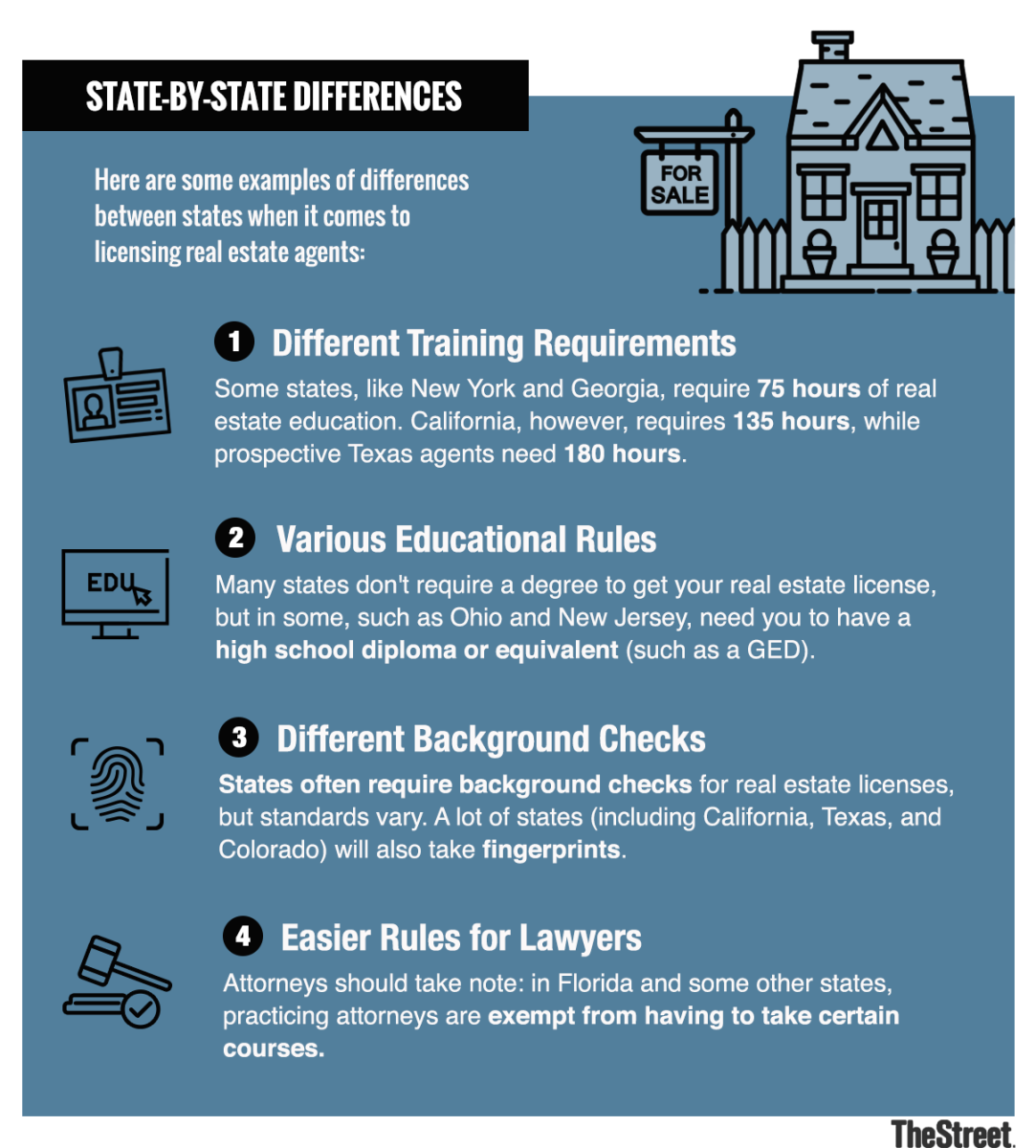

A real estate agent can be defined as an individual licensed by the state in order to lease or sell real estate. A broker can employ them, or they can be self employed. You need to be able to distinguish between a broker or a real estate agent in order for you get the best experience.

A broker oversees the activities of real estate agents. They are responsible for overseeing the management of real estate documents, recording all monies correctly, and determining if a deal was a success. They are also capable of mediating legal disputes. They are also better trained than real estate salespeople. They can represent both the seller and buyer in a dual-agency situation. Some states make it illegal.

A broker might not have an office in person, but many states have websites that consumers can use to find out more about a broker. They can also learn a lot about an agent’s reputation. It is also worth looking at the number and success rate of the agent's listings and deals. The more successful an agent is the greater the commission they will earn. It's worth paying more for the broker if it means you get the most money.

Brokers can sponsor licenses for other real estate agents. In some cases this is done to allow for the growth of the business. Although the broker is not required to lead the team, he/she can. You can look at the policies of brokerage to see if you're working with a team.

A real estate broker serves two purposes: to protect the buyer and the seller. They will also ensure that all real property transactions are legal. In some states the buyer's agent has to act as a fiduciary. This means that they must be able spot potential problems in the property. It is best for both parties to find an expert who will represent their interests. A good broker will get the job done more effectively than a poor agent.

You should consult an expert when buying a home. They will know the market well and be able to help you decide how much you can afford. This is just as important than deciding how much house you can afford. If you are renting a property, it is important to check that the landlord has a strong reputation and is well-respected. New York City is a great example. A large majority of buyers and seller use a professional real estate agent.

FAQ

How much will it cost to replace windows

Replacement windows can cost anywhere from $1,500 to $3,000. The exact size, style, brand, and cost of all windows replacement will vary depending on what you choose.

How do I calculate my interest rate?

Interest rates change daily based on market conditions. The average interest rate over the past week was 4.39%. Add the number of years that you plan to finance to get your interest rates. For example, if you finance $200,000 over 20 years at 5% per year, your interest rate is 0.05 x 20 1%, which equals ten basis points.

What are the benefits associated with a fixed mortgage rate?

A fixed-rate mortgage locks in your interest rate for the term of the loan. You won't need to worry about rising interest rates. Fixed-rate loans offer lower payments due to the fact that they're locked for a fixed term.

What amount of money can I get for my house?

This can vary greatly depending on many factors like the condition of your house and how long it's been on the market. Zillow.com says that the average selling cost for a US house is $203,000 This

Can I get another mortgage?

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is used to consolidate or fund home improvements.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How to Locate Houses for Rent

Moving to a new area is not easy. But finding the right house can take some time. When choosing a house, there are many factors that will influence your decision making process. These factors include the location, size, number and amenities of the rooms, as well as price range.

We recommend you begin looking for properties as soon as possible to ensure you get the best deal. Ask your family and friends for recommendations. This will ensure that you have many options.