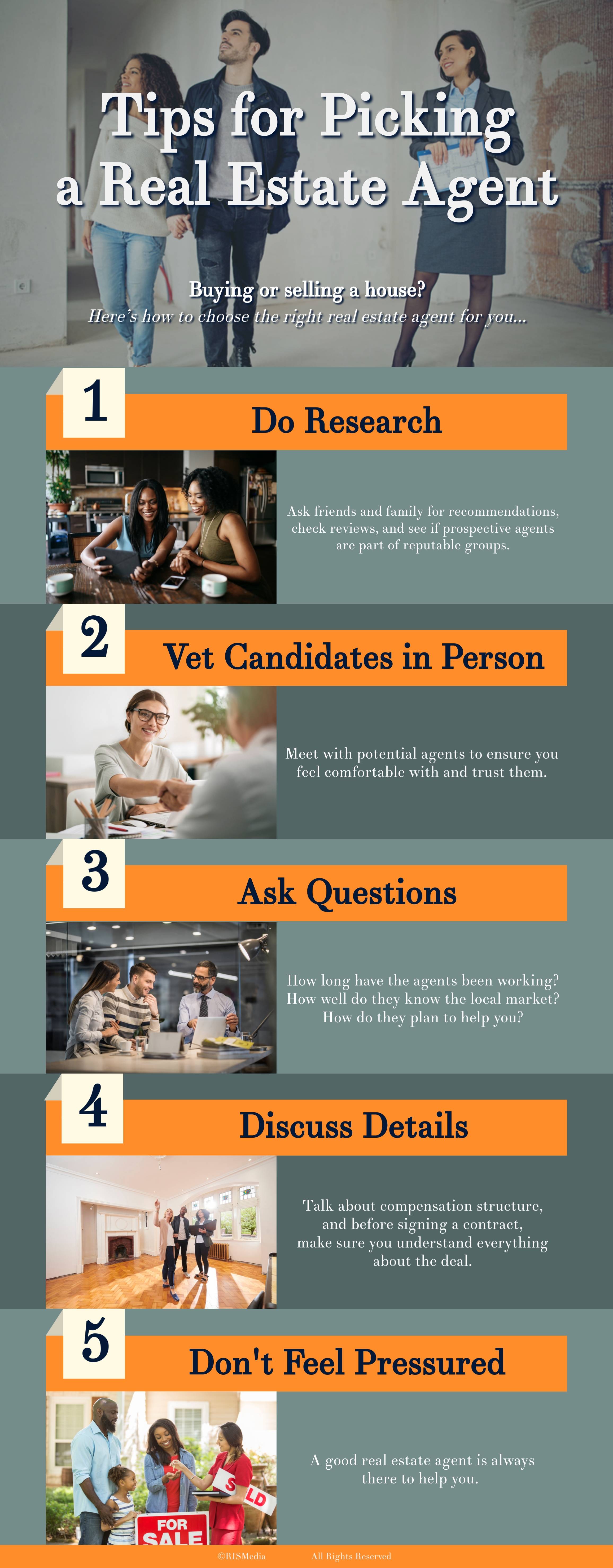

A stressful and difficult process can lead to a real estate license application. It will require you to take a series of courses, pass an examination, and find a sponsor broker. It's not an easy task but it is worth the effort if you are motivated.

The first step in getting your license is to complete the Texas Real Estate Commission (TREC) application. You can apply online at myLicenseTexas.com. This will cover the cost of your application, as well as a $10 fee that goes to the Texas Real Estate Recovery Fund.

After you have submitted your application, the next step is to select the date/location for your real estate exam. This exam must be scheduled at least four weeks before the actual date and time. You should also allow yourself sufficient time to prepare. Each section is approximately four hours long.

Pre-license classes will provide you with a range of real estate classes that will help you get your Texas license. These classes will give you an in-depth understanding of the ethics and practice of real estate.

The course will also teach you about Texas' market and what it is like to be an agent. Additionally, you'll learn how to market yourself to potential clients and other professionals.

Also, you will learn about the types of real-estate such as residential and business properties. Additionally, you will learn how to use CRMs and other marketing tools to make your business stand out from the rest.

Once you've taken all required courses and passed a background check, it's now time to apply in Texas for a real-estate license. The Texas Real Estate Commission(TREC) will review your application, and then email you an Eligibility Letter that you can use in order to make a reservation for Texas licensing exams.

Before you can sit for the exam, you'll need to get fingerprinted and submit a criminal history report. This information is needed to determine if any of your previous convictions have resulted in you being unable to hold a license.

It is not unusual for new real estate professionals to have difficulty with the Texas licensing process. There is an easy way around these problems.

Transferring your Texas license is possible if you already have a license in Texas. While you'll need to complete the entire licensing process over again, it's faster than if everything was done completely from scratch.

Once you have received your TREC eligibility letter, you can begin looking for courses that will prepare you for the licensing exam. Quality pre-license courses will contain practice tests, which will be scientifically proven as one of the best ways for you to study to get your Texas real estate license.

FAQ

Do I require flood insurance?

Flood Insurance covers flooding-related damages. Flood insurance helps protect your belongings and your mortgage payments. Find out more about flood insurance.

What are the 3 most important considerations when buying a property?

The three main factors in any home purchase are location, price, size. The location refers to the place you would like to live. Price refers how much you're willing or able to pay to purchase the property. Size refers how much space you require.

How do I get rid termites & other pests from my home?

Your home will eventually be destroyed by termites or other pests. They can cause serious damage to wood structures like decks or furniture. It is important to have your home inspected by a professional pest control firm to prevent this.

How much will my home cost?

It depends on many factors such as the condition of the home and how long it has been on the marketplace. Zillow.com reports that the average selling price of a US home is $203,000. This

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How to be a real-estate broker

Attending an introductory course is the first step to becoming a real-estate agent.

Next you must pass a qualifying exam to test your knowledge. This requires you to study for at least two hours per day for a period of three months.

Once you have passed the initial exam, you will be ready for the final. To be a licensed real estate agent, you must achieve a minimum score of 80%.

Once you have passed these tests, you are qualified to become a real estate agent.