These are the steps to follow if you're interested in obtaining your Kansas real-estate license. These include completing a real estate course, passing the licensing exam, and completing a background check. Once you've completed all of these tasks, you can begin to look for a broker and start selling homes.

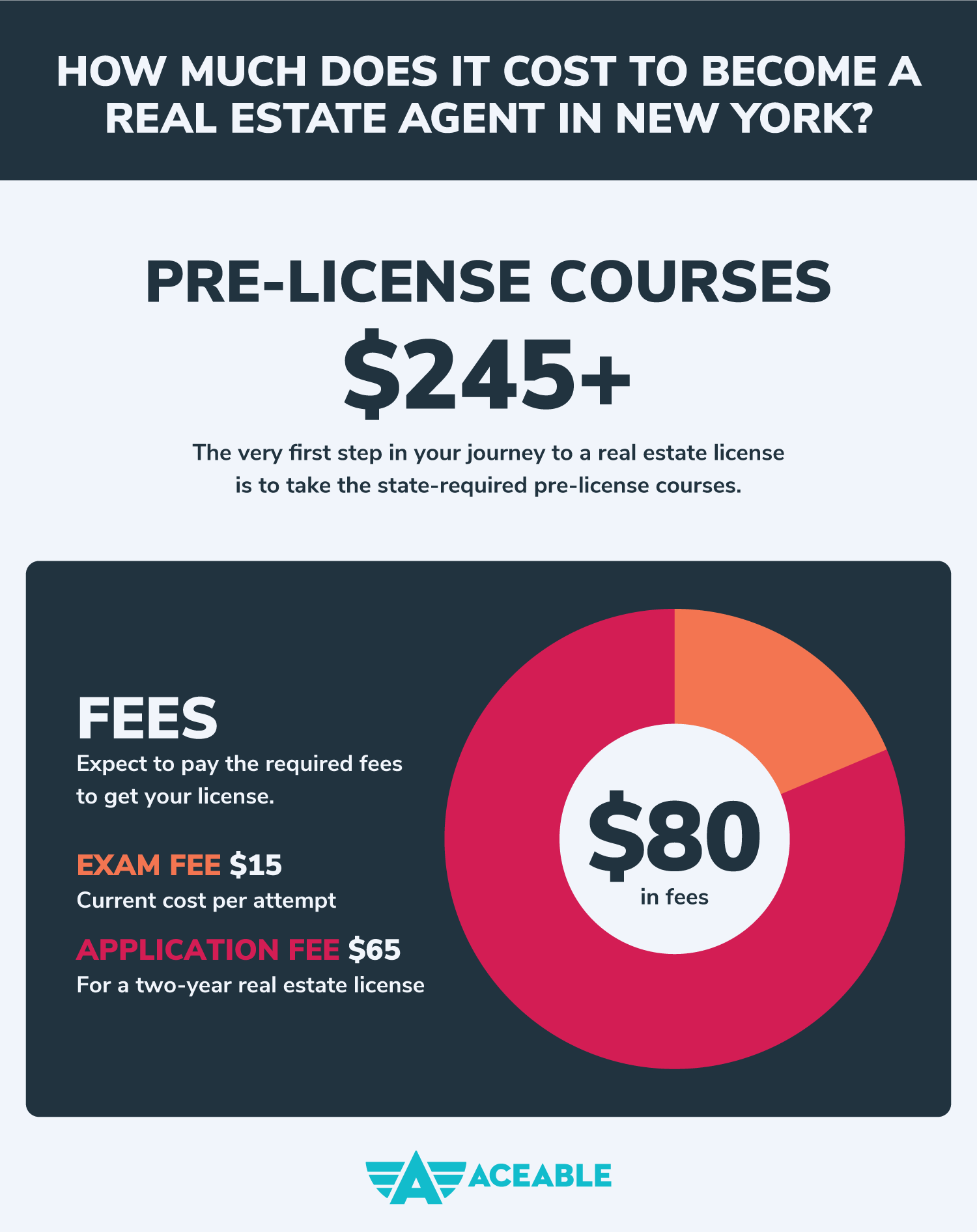

Pre-licensing is the first step. This course must be completed by a state-approved, 60-hour real estate school. This course can be taken online or in person. It is recommended to choose a school that has a reputation for quality education.

After you've finished your pre-licensing course, the next step is registering for your exam. Pearson VUE administers the exam on behalf of Kansas Real Estate Commission.

Once you've registered, you'll receive a schedule of exams and a registration number that will allow you to access your exam from any computer with internet access. Your fingerprints and completed background check form will be required.

How to Pass Kansas Real Estate Exam

For the real-estate exam, you must score at minimum 70% in each section (the Kansas or the National). If you fail the exam, you can take it again. However, you will need to wait 24 hours before scheduling a reexam.

You can also take the exam again if you fail, provided you do it within six months. You will have to pay a fee to retake the exam.

How to Get a Kansas Real Estate License

Kansas's process for getting a real estate license is quite simple. The minimum age to obtain a Kansas real estate license is 18 years.

A course that covers the Kansas Real Estate Salesperson exam will be a great choice for you when you are ready to take it. This will ensure that you are ready for the exam.

Colibri Real Estate offers four different prelicensing packages. Each package is self-paced. They are easy-to-follow and offer a Pass Guarantee or Don't Pay.

Save 25% with our discount code "TheClose25" at checkout for any Colibri Real Estate Kansas prelicensing course.

Choosing a Real Estate Broker in Kansas

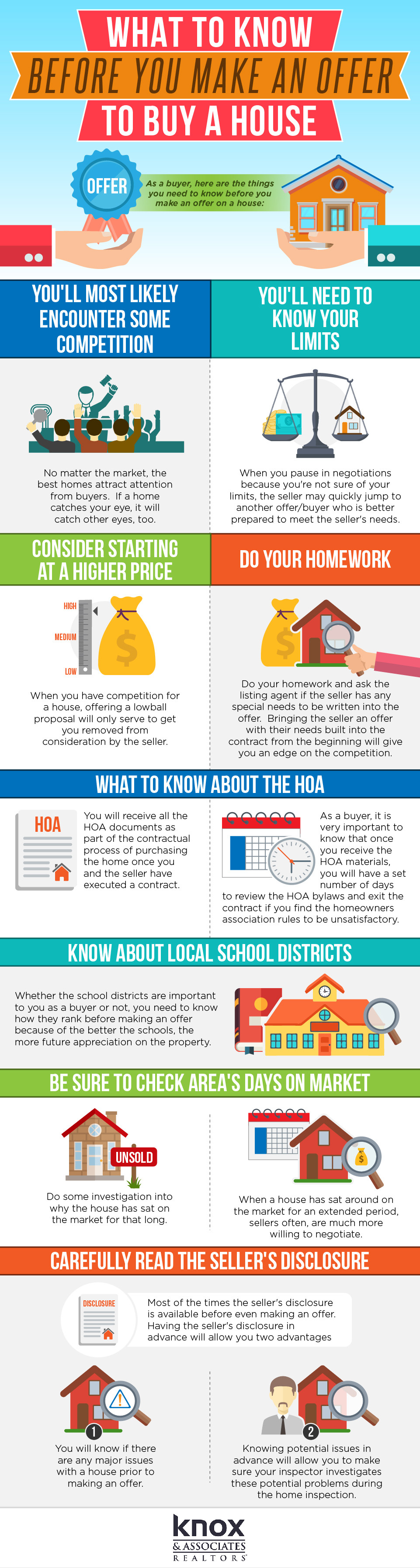

Before you can become a licensed real estate agent, it is essential that you partner with a trustworthy brokerage. A good broker can provide you with training and resources, as well as help you to grow your business.

Being a good broker will help you feel confident in your career and give you the security of knowing they are there to support you. You should inquire about the business model and commission structure of the brokerage and how they support their agents in their educational and career development.

FAQ

What is the average time it takes to get a mortgage approval?

It depends on several factors such as credit score, income level, type of loan, etc. It generally takes about 30 days to get your mortgage approved.

How do I calculate my rate of interest?

Market conditions impact the rates of interest. In the last week, the average interest rate was 4.39%. The interest rate is calculated by multiplying the amount of time you are financing with the interest rate. Example: You finance $200,000 in 20 years, at 5% per month, and your interest rate is 0.05 x 20.1%. This equals ten bases points.

How can I get rid Termites & Other Pests?

Over time, termites and other pests can take over your home. They can cause damage to wooden structures such as furniture and decks. A professional pest control company should be hired to inspect your house regularly to prevent this.

What is a Reverse Mortgage?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. It allows you to borrow money from your home while still living in it. There are two types of reverse mortgages: the government-insured FHA and the conventional. If you take out a conventional reverse mortgage, the principal amount borrowed must be repaid along with an origination cost. FHA insurance covers the repayment.

How many times can I refinance my mortgage?

It depends on whether you're refinancing with another lender, or using a broker to help you find a mortgage. In either case, you can usually refinance once every five years.

Do I need flood insurance?

Flood Insurance protects against damage caused by flooding. Flood insurance protects your belongings and helps you to pay your mortgage. Learn more about flood insurance here.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How do I find an apartment?

When you move to a city, finding an apartment is the first thing that you should do. This involves planning and research. It includes finding the right neighborhood, researching neighborhoods, reading reviews, and making phone calls. You have many options. Some are more difficult than others. The following steps should be considered before renting an apartment.

-

Online and offline data are both required for researching neighborhoods. Online resources include Yelp. Zillow. Trulia. Realtor.com. Other sources of information include local newspapers, landlords, agents in real estate, friends, neighbors and social media.

-

Review the area where you would like to live. Yelp, TripAdvisor and Amazon provide detailed reviews of houses and apartments. You might also be able to read local newspaper articles or visit your local library.

-

For more information, make phone calls and speak with people who have lived in the area. Ask them what they loved and disliked about the area. Also, ask if anyone has any recommendations for good places to live.

-

Be aware of the rent rates in the areas where you are most interested. Consider renting somewhere that is less expensive if food is your main concern. If you are looking to spend a lot on entertainment, then consider moving to a more expensive area.

-

Learn more about the apartment community you are interested in. What size is it? What is the cost of it? Is it pet-friendly What amenities does it have? Are there parking restrictions? Do tenants have to follow any rules?