If you're looking for a multi family mortgage loan, there are several factors that you should consider. These factors include down payment, interest rates, and other financing options. This article will provide information on the down payment and rates for these types loans. These details will help you choose the right mortgage loan for you.

Multifamily mortgage loan rates

There are several factors that impact the interest rate of multi-family mortgage loans. These loans have higher reserve requirements than conventional loans. Because multifamily loans carry a higher risk, this is why they have higher reserve requirements. Buyers should search for lenders that specialize in multifamily loans.

Traditional FHA mortgages allow borrowers to buy multifamily properties with up to four units. The program's benefits include a low down payment, and a lower interest rates. Additional benefits include lower DTI and stringent requirements.

Requirements for down payment

The down payment requirements for multifamily mortgage loans are different depending on what type of property. A down payment for multifamily mortgage loans may be 20% for a property that has three units, but only 5% for a property that has two units. Different banks have different guidelines about how much down payment is required for multifamily properties.

While the down payment required for multi-family properties is significantly higher than that of single-family homes, you can still get approved with a low down payment. A few programs may require as little down as 5%, while some lenders may allow you to pay as little down as 1%. Programs that allow you use the downpayment of a relative or parent in order to finance a part of your mortgage can also be found.

Minimum interest rate requirements

There are several requirements that must be met before you can apply for a multi-family loan. Pre-qualification is the first step. This involves an assessment of your credit, income, assets, and other information. Most lenders require a minimum credit score of 620 in order to approve you for a loan.

Alternate financing options

Alternative financing comes with some problems. The challenges include limited documentation, lack of data regarding alternative financing effectiveness, and wide differences between states in the types. The lack of research can hinder policymakers from assessing the harms and benefits of alternative financing.

Private equity, online marketplaces, and debt funds are some of the alternatives to multifamily mortgage loan financing. Private equity funds often finance commercial real estate transactions. These funds combine the capital of several investors to provide equity or debt financing to borrowers. This type financing is not appropriate for all circumstances and requires careful research.

FAQ

Is it possible to sell a house fast?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. However, there are some things you need to keep in mind before doing so. First, you will need to find a buyer. Second, you will need to negotiate a deal. You must prepare your home for sale. Third, it is important to market your property. Finally, you need to accept offers made to you.

How can I repair my roof?

Roofs may leak from improper maintenance, age, and weather. Repairs and replacements of minor nature can be made by roofing contractors. For more information, please contact us.

What are the pros and cons of a fixed-rate loan?

With a fixed-rate mortgage, you lock in the interest rate for the life of the loan. You won't need to worry about rising interest rates. Fixed-rate loans come with lower payments as they are locked in for a specified term.

How much money can I get to buy my house?

This varies greatly based on several factors, such as the condition of your home and the amount of time it has been on the market. According to Zillow.com, the average home selling price in the US is $203,000 This

Can I afford a downpayment to buy a house?

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. Check out our website for additional information.

Are flood insurance necessary?

Flood Insurance protects you from flooding damage. Flood insurance helps protect your belongings and your mortgage payments. Learn more about flood insurance here.

What should you think about when investing in real property?

First, ensure that you have enough cash to invest in real property. If you don’t have the money to invest in real estate, you can borrow money from a bank. Also, you need to make sure you don't get into debt. If you default on the loan, you won't be able to repay it.

You should also know how much you are allowed to spend each month on investment properties. This amount must be sufficient to cover all expenses, including mortgage payments and insurance.

Also, make sure that you have a safe area to invest in property. It would be best if you lived elsewhere while looking at properties.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

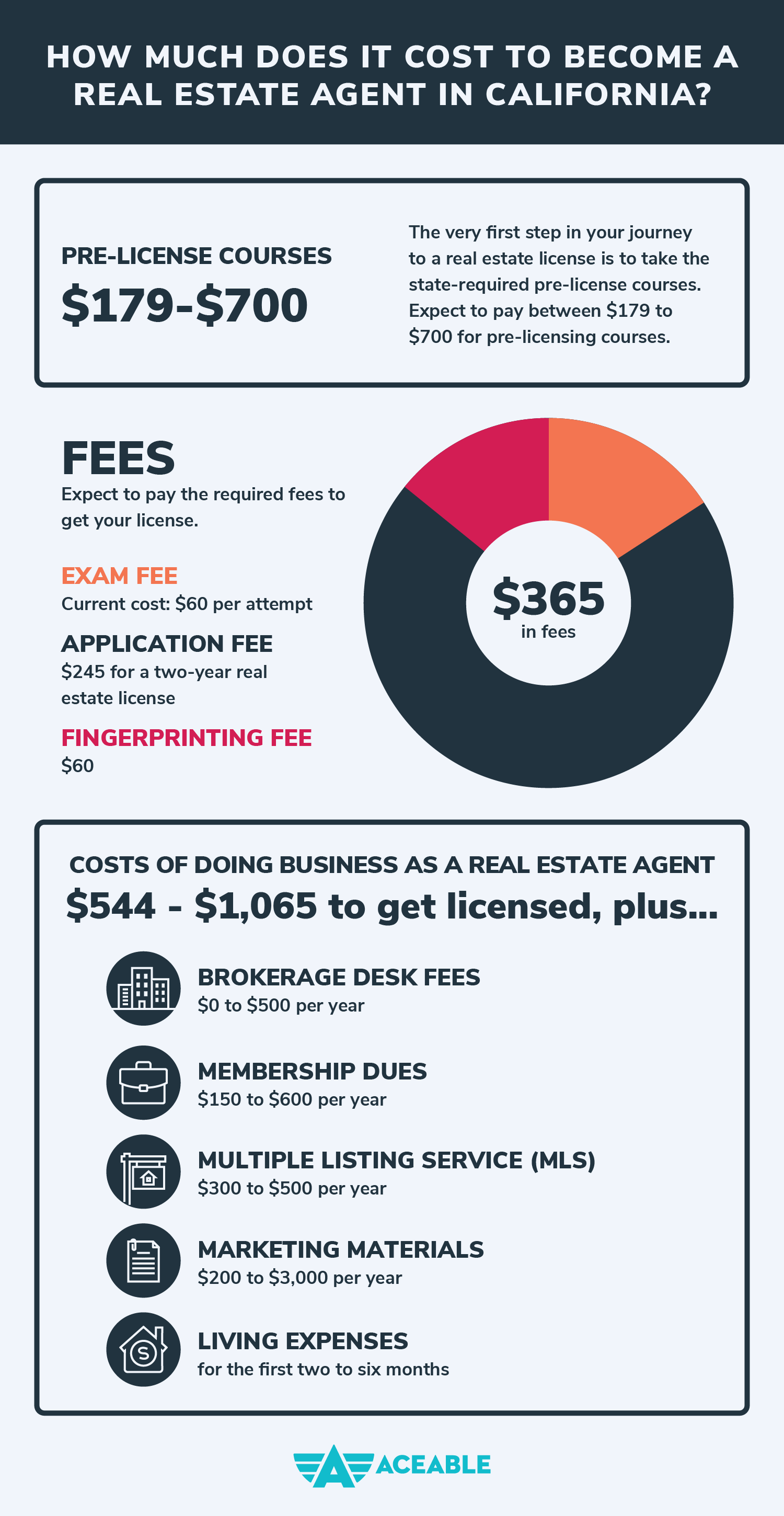

How to become a broker of real estate

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next, pass a qualifying test that will assess your knowledge of the subject. This means that you will need to study at least 2 hours per week for 3 months.

You are now ready to take your final exam. You must score at least 80% in order to qualify as a real estate agent.

These exams are passed and you can now work as an agent in real estate.