To be eligible for the Washington real property licensing exam, you will need to bring two forms ID. Each form should include your name, signature, current photograph, and date. Also, the exam's results are only valid for one year. This means that you will have to apply for your broker’s license before they expire. You will receive instructions for how to take the exam again if you fail it. Once you pass the exam you can submit an official application.

Pre-licensing education requirements

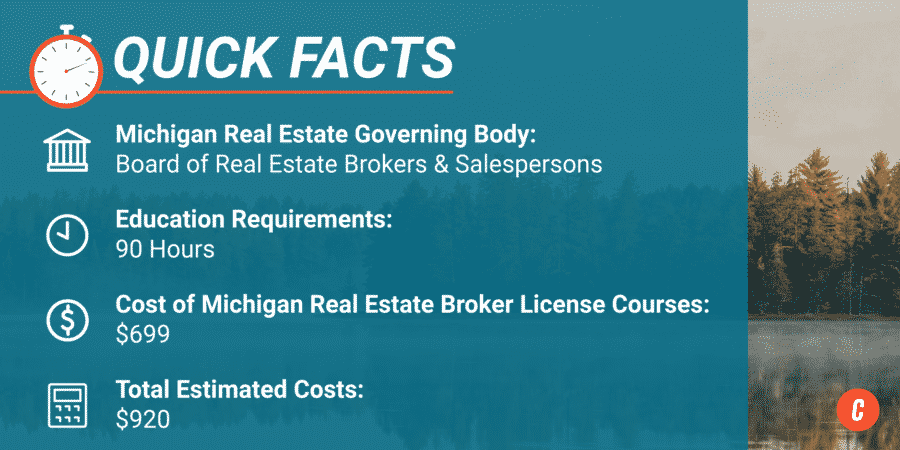

Washington requires that every aspiring real-estate agent completes at least 90 hours pre-licensing training before taking the exam. This 90-hour course includes courses in real estate contracts, principles, finance, and many other topics. The online courses provide access to multiple modules which cover different topics. Students will receive study guides and optional exams that will help them prepare for the real estate exam.

Washington State Department of Licensing and Regulation requires each applicant to pass background checks before they can take the realty exam. Candidates must register at the state's licensing agency to be eligible for the exam. Candidates must also show proof of their course completion. They must pass the broker's exam, and answer legal background questions. Additionally, applicants must submit fingerprints for background checks every six-years. This information can be used by applicants who have already completed pre-licensing studies in another country.

Exam content

The WA licensing exam in real estate includes two parts. One is the national section and one is the state-specific. Questions from both sections are interspersed. About five to ten questions will be considered experimental and not scored. Both parts have multiple-choice questions. It takes 3.5 hours to complete each. To pass, you will need a scaled score between 70 and 80. The test content covers all aspects of state real estate laws, contracts and procedures.

Pre-licensing courses cover many of the same topics that the exam. The basics of real estate math are required. It is important to practice the test frequently as subjects are constantly changing. Practice tests are a good idea to make sure you know the format well and note your weak spots. A few math formulas and facts from your pre-licensing course should be memorized.

Cost

The cost of wa real estate licensing varies from state to state, and varies with the type of business you run. A broker license costs more than a salesperson, which requires additional schooling. If you are starting from scratch, the costs of real estate licensing can be higher, but you can cut these costs by creating a business plan and identifying your target clients. You have many marketing options, including print ads, digital ads and social media campaigns.

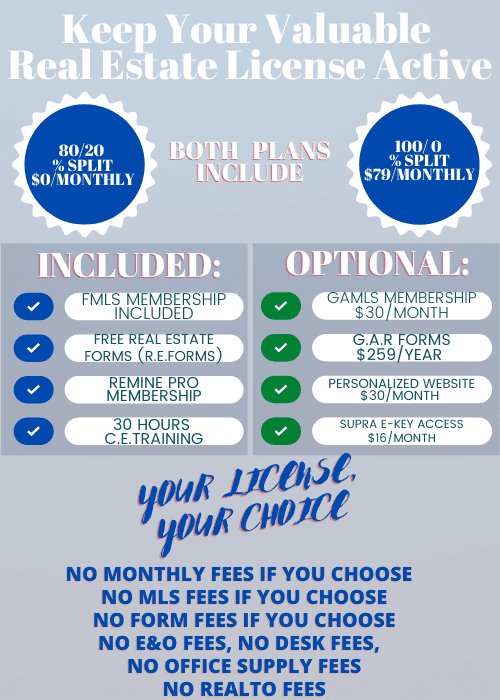

The cost of pre-licensing coursework will range from $260 to $500, depending on where you choose to take it. After you complete the required course, your state licensing exam must be passed. Additional fees of $50-60 are required for MLS membership. The fees for MLS membership vary from one region to the next. You'll need to verify your local fees to find out the exact cost. You will also likely have to pay a small fee in order to become a member of National Association of Realtors. This fee is separate.

Online options

Online schools can be a great option for Washington real estate license requirements. Online schools are more flexible than traditional schools. You can work at your own pace and access the information you need. This will allow you to complete your education in as little as possible. In addition to the online classes, you will get valuable exam prep services and tutor support from instructors. Exam Preparation Plus allows you to purchase an upgrade for your course. This includes a real e-book, live exam cramer series and Q&A sessions.

Kaplan offers five WA Pre-licensing Packages. You can choose from the Premium or Value packages depending on your needs. These packages offer three online courses with a total of nine credit hours. Both packages allow for flexibility in how you work and can be resumed from where you left off. Kaplan's courses have been developed by real estate professionals who are experts in current and relevant topics.

FAQ

How can I repair my roof?

Roofs may leak from improper maintenance, age, and weather. Roofing contractors can help with minor repairs and replacements. Get in touch with us to learn more.

What are the three most important factors when buying a house?

The three main factors in any home purchase are location, price, size. Location refers the area you desire to live. Price refers how much you're willing or able to pay to purchase the property. Size refers to how much space you need.

What should I be looking for in a mortgage agent?

A mortgage broker is someone who helps people who are not eligible for traditional loans. They shop around for the best deal and compare rates from various lenders. Some brokers charge a fee for this service. Others offer no cost services.

What time does it take to get my home sold?

It depends on many factors, such as the state of your home, how many similar homes are being sold, how much demand there is for your particular area, local housing market conditions and more. It takes anywhere from 7 days to 90 days or longer, depending on these factors.

What are the key factors to consider when you invest in real estate?

The first thing to do is ensure you have enough money to invest in real estate. You will need to borrow money from a bank if you don’t have enough cash. Aside from making sure that you aren't in debt, it is also important to know that defaulting on a loan will result in you not being able to repay the amount you borrowed.

You must also be clear about how much you have to spend on your investment property each monthly. This amount should include mortgage payments, taxes, insurance and maintenance costs.

Finally, you must ensure that the area where you want to buy an investment property is safe. It is best to live elsewhere while you look at properties.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

How to manage a rental property

You can rent out your home to make extra cash, but you need to be careful. These tips will help you manage your rental property and show you the things to consider before renting your home.

Here are some things you should know if you're thinking of renting your house.

-

What is the first thing I should do? You need to assess your finances before renting out your home. If you have outstanding debts like credit card bills or mortgage payment, you may find it difficult to pay someone else to stay in your home while that you're gone. Check your budget. If your monthly expenses are not covered by your rent, utilities and insurance, it is a sign that you need to reevaluate your finances. You might find it not worth it.

-

What is the cost of renting my house? There are many factors that go into the calculation of how much you can charge to let your home. These include things like location, size, features, condition, and even the season. Keep in mind that prices will vary depending upon where you live. So don't expect to find the same price everywhere. Rightmove estimates that the market average for renting a 1-bedroom flat in London costs around PS1,400 per monthly. This means that you could earn about PS2,800 annually if you rent your entire home. This is a good amount, but you might make significantly less if you let only a portion of your home.

-

Is it worth it? You should always take risks when doing something new. But, if it increases your income, why not try it? It is important to understand your rights and responsibilities before signing anything. You will need to pay maintenance costs, make repairs, and maintain the home. Renting your house is not just about spending more time with your family. Make sure you've thought through these issues carefully before signing up!

-

Are there any advantages? There are benefits to renting your home. There are many reasons to rent your home. You can use it to pay off debt, buy a holiday, save for a rainy-day, or simply to have a break. It is more relaxing than working every hour of the day. If you plan ahead, rent could be your full-time job.

-

How do I find tenants? After you have decided to rent your property, you will need to properly advertise it. Online listing sites such as Rightmove, Zoopla, and Zoopla are good options. Once potential tenants reach out to you, schedule an interview. This will help you assess their suitability and ensure they're financially stable enough to move into your home.

-

What can I do to make sure my home is protected? You should make sure your home is fully insured against theft, fire, and damage. In order to protect your home, you will need to either insure it through your landlord or directly with an insured. Your landlord will typically require you to add them in as additional insured. This covers damages to your property that occur while you aren't there. If you are not registered with UK insurers or if your landlord lives abroad, however, this does not apply. In such cases you will need a registration with an international insurance.

-

If you work outside of your home, it might seem like you don't have enough money to spend hours looking for tenants. But it's crucial that you put your best foot forward when advertising your property. A professional-looking website is essential. You can also post ads online in local newspapers or magazines. You'll also need to prepare a thorough application form and provide references. Some people prefer to do everything themselves while others hire agents who will take care of all the details. You'll need to be ready to answer questions during interviews.

-

What should I do once I've found my tenant? If you have a lease in place, you'll need to inform your tenant of changes, such as moving dates. Otherwise, you can negotiate the length of stay, deposit, and other details. While you might get paid when the tenancy is over, utilities are still a cost that must be paid.

-

How do I collect rent? When it comes to collecting the rent, you will need to confirm that the tenant has made their payments. If they haven't, remind them. You can subtract any outstanding rent payments before sending them a final check. You can always call the police to help you locate your tenant if you have difficulty getting in touch with them. The police won't ordinarily evict unless there's been breach of contract. If necessary, they may issue a warrant.

-

What can I do to avoid problems? It can be very lucrative to rent out your home, but it is important to protect yourself. You should install smoke alarms and carbon Monoxide detectors. Security cameras are also a good idea. Check with your neighbors to make sure that you are allowed to leave your property open at night. Also ensure that you have sufficient insurance. You should not allow strangers to enter your home, even if they claim they are moving in next door.